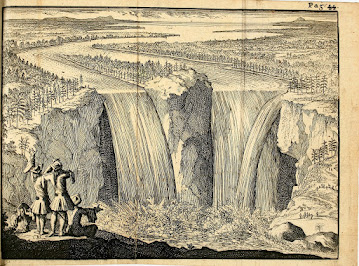

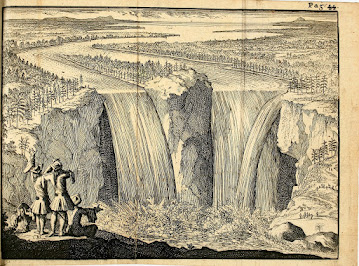

Fakta fakta tentang air terjun niagara

This implies one thing: for customer to spare, discover great benefit, and get a great rate on their auto protections, they got to shop, shop, shop. It could seem basic, but agreeing to ponders by a major online carrier, as it were 20% of the individuals studied really get more than one cite some time recently buying their insurance. Experts concur that getting a blend of cites from huge as well as little guarantees will provide you a great blend. Insurance-Info-Center.com lets you choose from a wide assortment of national safeguards through their robotized providers.

Specialists too recommend that, indeed with the comfort and speed of online cites, you ought to counsel nearby suppliers as well. In the long run you ought to shop around, and get cites from as numerous places as you'll before making a final choice. Within the conclusion, it'll spare you huge money. What Ought to You See Out For When Getting Cheap Auto Insurance? When shopping for auto protections, it is imperative merely look for out the finest bargains for your cash. Numerous are beneath the impression that car protections rates are decided by the overall quality of the vehicle insurance that's provided. In any case, there are numerous companies out there that offer cheap auto protections and offer quality benefits, and services. Here, you may be presented to a number of things that you just ought to see out for when it comes to getting cheap auto protections. Whether you're shopping for rates that will cover a utilized vehicle, or a modern one, these accommodating methods will help you in your endeavor

One of the exceptionally to begin with things that you simply ought to do when looking for the cheapest auto protections rates is to form a individual commitment to shop and compare. It is imperative to not fair compare the costs of the scope that's advertised by different protections companies. It is similarly imperative to compare the administrations and the benefits that are related with the scope itself. Numerous times, you will discover that a better costing protections scope may not offer as numerous benefits to you as a moo costing protections can, or bad habit versa. Be that as it may, in case you take the time to shop and compare each perspective of the scope, you're beyond any doubt to discover out a few things that capture your intrigued.

The following thing merely ought to see out for when it comes to shopping for car protections is rebates. Yes, numerous car protections companies promote rebates for secure drivers, and comparable rebates but did you know that many companies have rebates accessible that they don't promote? When calling approximately your possibly modern arrangement in car protections, be beyond any doubt to ask about discounts. In conclusion, there are numerous distinctive things that you simply ought to search for when it comes to your car protections. The things said all through this direct can lead you to spare hundreds on your car protections each year. In the event that you're looking to get cheap car protections, you must know and get it the nuts and bolts behind the costs that are charged for car insurance.

Why Do I Need Auto Insurance?

There are a number of reasons why you would like to buy auto protections, but the foremost likely reason is cash. At whatever point an mishap happens there's continuously a taken toll related with repairing damage to cars, harm to property and the therapeutic needs of people included. This is often where auto protections comes in, it covers all of these costs and as a rule as it were at a division of the fetched.

On the off chance that your not as of now persuaded that you simply NEED Auto Protections at that point here could be a list of reasons why you would like Auto Insurance: It will ensure the speculation you’ve made in your car It will pay for the progressing therapeutic costs when somebody is harmed or injured It will shield you from exorbitant harms from an accident-related lawsuit It will ensure you from uninsured motorists It will pay for other occasions such as robbery, normal catastrophes such as fire Saves you cash on huge repair bills It is the law in a few states You will have peace of mind These are only a short list of conceivable reasons and they might not all apply to you. But at slightest one will which may be a great sufficient reason to buy auto insurance.

When you consider the degree of seriousness of many of the

nation’s auto accidents, the costs of treating injured people from these events

can be staggering. Even a short stay in a hospital without surgeries and

advanced procedures can run into the tens of thousands of dollars.

Why do you need auto insurance? You need it to cover the

times when you’ve tried to avoid an accident but just weren’t able to. You need

it to cover the times you hit black ice and spin out, hitting the median. You

need it to make sure you’re not going to have to pay for someone else’s mistake

when they don’t have insurance, as well as you paying for your own mistake

because you didn’t have insurance.

I hope that this answers your question and you decide to go

out and purchase auto insurance even if not for your own benefit, but for the

benefit of others.

Five Auto Insurance Tips

Choosing the right Auto Insurance for you can be a daunting

task, these tips will help you to make the right decision.

Get More than One Quote

When purchasing auto insurance you need to make sure you are

getting the cheapest insurance for your needs. To do this you need to get

quotes from a number of insurance companies and then select the most suitable

one for your budget. It is very rare for insurance companies to offer the same

rate and give you the same coverage. So it pays to shop around.

Only Pay for What You Need

Auto Protections approaches regularly have a number of alternatives to cater for the shifting needs of car proprietors and more regularly than not you won’t require all of the choices. In case you possess a car that's ancient and corroded and scarcely worth anything at that point don’t get full scope, as it were pay for protections that covers you on the off chance that you hit somebody else. There are too alternatives such as a contract car for when your car is in for repairs after an accident, in the event that you've got other implies for getting around at that point don’t choose this alternative. Selecting the leading choices for you'll be able spare you a extraordinary bargain of cash.

Review Your Insurance

Insurance companies don’t usually review your policy to ensure you are getting the best deal, they are happy for you to pay more than you should be. So at least once a year you should call your insurance company and ask them for a loyal customer discount and also get a few quotes from other insurance companies to ensure that you are getting the best deal.

No Little Claims

The ideal purpose of auto insurance is to cover the cost of

major repairs to your car or for damage done to other people’s property or to

persons involved in an accident. Making a claim for something as trivial as a

scratch or dent can cause your insurance rate to increase and end up costing

you more than simply paying to get the damage fixed yourself.

Keep All Insurance with One Company

If you have more than one insurance policy, then it is best

to keep all of the policy’s with one insurance company. Insurance companies

will often give you a discount for keeping all of your policies with them. This

will also make it easier to keep track of your insurance when you need to make

a claim or update a policy.

Comments

Post a Comment